We know you: you have a Pinterest board full of home improvement ideas, motivational quotes and dream interiors you’d like to replicate. As a child you played with Legos and built the home you wanted one block at a time complete with furniture. You, and millions of other perpetual DIY-ers, have dreamed of creating a space to call home, but find yourself instead with a pile of repairs, mountains of debt and a stockpile of paint colors you never got to use. This was the home you’d planned to make your own: but is it really worth it? All Homes AZ has simple questions to ask yourself to determine if your house is worth the work – or if it’s time to sell your current home for cash and invest in a new home. Continue reading

We know you: you have a Pinterest board full of home improvement ideas, motivational quotes and dream interiors you’d like to replicate. As a child you played with Legos and built the home you wanted one block at a time complete with furniture. You, and millions of other perpetual DIY-ers, have dreamed of creating a space to call home, but find yourself instead with a pile of repairs, mountains of debt and a stockpile of paint colors you never got to use. This was the home you’d planned to make your own: but is it really worth it? All Homes AZ has simple questions to ask yourself to determine if your house is worth the work – or if it’s time to sell your current home for cash and invest in a new home. Continue reading

Category Archives: Selling Homes

Why Your Home Isn’t Selling on the Market

Have you finally decided to list your home? Perhaps the property has only been on the real estate market for a month or two and the hopes of selling are still high. However, if the listing has been up for longer than expected and shows little potential, it can be infuriating. At All Homes AZ, we understand the headache that comes with selling property. Homeowners sell their estate for several reasons, including a need for cash, a desire to move, a job transfer, and more. Regardless of the cause, when the property does not receive offers, life takes a bit of a frustrating halt. Continue reading

Have you finally decided to list your home? Perhaps the property has only been on the real estate market for a month or two and the hopes of selling are still high. However, if the listing has been up for longer than expected and shows little potential, it can be infuriating. At All Homes AZ, we understand the headache that comes with selling property. Homeowners sell their estate for several reasons, including a need for cash, a desire to move, a job transfer, and more. Regardless of the cause, when the property does not receive offers, life takes a bit of a frustrating halt. Continue reading

Knowing When to Sell:

Have you become indecisive or maybe a little hesitant about whether you should sell your home? Do you go back and forth in your mind about if it is the right time to sell? Regardless of if you might be thinking of moving due to financial or geographical reasons, or simply because you feel that it’s time for a change, accepting the fact that it is time to sell can be difficult. Marketing the property, packing and moving are all trying steps that may feel overwhelming, but AllHomesAz.com can help. Continue reading

Have you become indecisive or maybe a little hesitant about whether you should sell your home? Do you go back and forth in your mind about if it is the right time to sell? Regardless of if you might be thinking of moving due to financial or geographical reasons, or simply because you feel that it’s time for a change, accepting the fact that it is time to sell can be difficult. Marketing the property, packing and moving are all trying steps that may feel overwhelming, but AllHomesAz.com can help. Continue reading

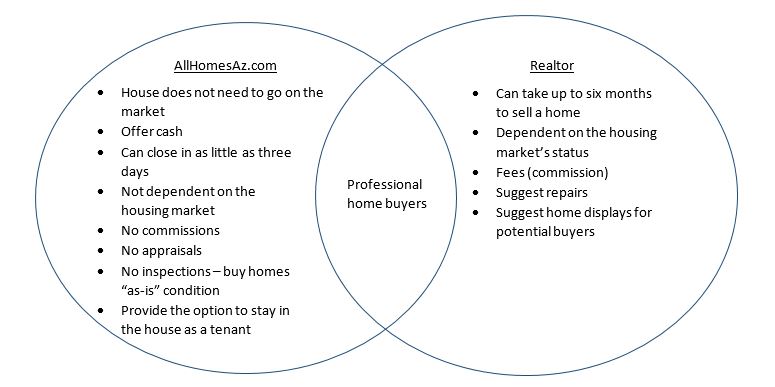

Realtor vs. AllHomesAz.com

Do you want to sell your home? Perhaps you would like to find a new location, or you simply need the financial assistance. Regardless of the reason, it is time to make a few decisions. First, it is important to consider how the house will be sold. Who will help? What option will provide the most profit? Is there a specific timeline? These are only a few of the many questions that need to be addressed.

Most residents believe that the only way to sell their home is through a realtor. AllHomesAz.com is here to prove that wrong. Our national company provides homeowners with another option, saving them time and money. There are several differences between realtors and AllHomesAz.com, illustrated here:

As illustrated, working with AllHomesAz.com will undoubtedly place homeowners in better hands. While realtors provide a sense of relief due to their networking and action of control, they come at a price. Realtors rely on commission for their services, whereas AllHomesAz.com does not. We understand that homeowners who need to sell their property quickly for cash might be financially troubled. Our company does not charge the residents. Rather, we even help with closing prices.

Both realtors and AllHomseAz.com offer real estate professionalism. With realtors, however, you never truly know how experienced each individual is. Our company promises to share our background. We have more than 10 years of experience in paying cash for houses, and we want to share that knowledge with homeowners. Providing residents with cash for their homes in a maximum of three days is our specialty.

So if you want to hire a realtor to help sell your house, think again. Contact us by phone or email at any time; we are reachable 24 hours a day, seven days a week. You can also fill out our form to receive a cash offer for your property. All information is confidential, as AllHomesAz.com knows and respects the importance of privacy and a trusting work relationship. Receive cash for your home today by choosing AllHomesAz.com!

Cash for Inherited Homes

Have you recently inherited a home from a loved one? Are you overwhelmed by the various decisions and actions that must be taken? AllHomesAz.com knows that beneficiaries of real estate take on quite a bit of responsibility, as there are several concerns when it comes to inheritance. To bequeath a home is a tremendous gesture, but it does come with complications. Continue reading

Have you recently inherited a home from a loved one? Are you overwhelmed by the various decisions and actions that must be taken? AllHomesAz.com knows that beneficiaries of real estate take on quite a bit of responsibility, as there are several concerns when it comes to inheritance. To bequeath a home is a tremendous gesture, but it does come with complications. Continue reading

We Buy Your Home That Needs Repairs

Do you want to sell your house without investing in any repairs? AllHomesAz will buy your home regardless of its condition, so end the worrying now. Paint chips, leaky faucets and cracked windows are not a concern. You no longer need to save up and invest in costly repairs as this takes too much time and money. Instead, we can take the home off of your  hands now – and give you cash. AllHomesAz believes that every house is profitable, and we understand that homeowners do not want to put even more money into a place that they are going to leave. Continue reading

hands now – and give you cash. AllHomesAz believes that every house is profitable, and we understand that homeowners do not want to put even more money into a place that they are going to leave. Continue reading

What Causes a Home to Reach Foreclosure?

Foreclosure is the process by which a lender takes back ownership of a property from whomever borrowed money to purchase the property. This occurs when the borrower no longer makes the mortgage loan payments on time. So what causes someone to reach foreclosure on their home?

Foreclosure is the process by which a lender takes back ownership of a property from whomever borrowed money to purchase the property. This occurs when the borrower no longer makes the mortgage loan payments on time. So what causes someone to reach foreclosure on their home?

Arizona operates as a title theory state, which means that the lender holds the title to the property until the underlying loan obligation is paid in full. This gives the lender the right to foreclose on the property if the borrower defaults on the loan. The primary method of foreclosure in Arizona is known as non-judicial foreclosure, meaning that foreclosure does not involve a court action but requires notice commonly called foreclosure by advertisement.

Last year in Arizona, 34,387 properties completed foreclosure. This number may seem high, but with the market slowly turning up, the Phoenix-Mesa-Glendale housing market showed a decline in foreclosure rates in 2013, and that number is predicted to decline even further. This figure can be intimidating to those interested in keeping their home or even buying a new one, but there are plenty of reasons why someone could succumb to foreclosure besides just living beyond their means.

Negative Equity plays a major part in leading to foreclosure. This is where the borrower owes more on their loan than the house is worth. Since lenders will very rarely give a higher loan than the actual worth of the house, negative equity occurs when the price of the house drops, most likely from an economic downturn. Homeowners with equity have options if they run into financial trouble, such as refinancing. Foreclosure is typically the only option that homeowners without equity have.

There are a lot of factors that could contribute to a foreclosure that has nothing to do with the housing market. An illness or death in the family, especially occurring with the head of the household, can quickly result in a foreclosure if the mortgage is left unpaid due to other financial obligations. Divorce can play a major factor in a foreclosure, but the most common situation is when someone refuses to leave and the other refuses to pay the mortgage.

If you find yourself in the midst of a foreclosure, AllHomesAZ.com can help. At All Homes AZ, all consultations for foreclosures in Phoenix are free. No matter the situation, we will work with you to help settle your foreclosure at no cost. Please contact us today and get cash for your home – in any condition – in as little as three days!

Why Your Home Isn’t Selling

Many people that list their home on the market in the Phoenix or Tucson areas are fairly confident in their ability to find a buyer that will make a reasonable offer in a short amount of time. Unfortunately, it rarely works out that way. Some homes do receive offers very quickly, but even then it is sometimes the case that banks of Tucson and Phoenix that hold the mortgage will not be willing to look at any offer for the home, no matter how good. AllHomesAz.com has spent years studying the Phoenix and Tucson housing markets, and we have found that there are three main reasons that homes in Arizona do not sell.

Many people that list their home on the market in the Phoenix or Tucson areas are fairly confident in their ability to find a buyer that will make a reasonable offer in a short amount of time. Unfortunately, it rarely works out that way. Some homes do receive offers very quickly, but even then it is sometimes the case that banks of Tucson and Phoenix that hold the mortgage will not be willing to look at any offer for the home, no matter how good. AllHomesAz.com has spent years studying the Phoenix and Tucson housing markets, and we have found that there are three main reasons that homes in Arizona do not sell.

The Home is Not Priced to Sell

Overpricing is one of the worst mistakes a homeowner can make, because it can cause the property to sit on the market for longer periods of time, which decreases the value. You have to look at the price other homes in your neighborhood have sold for and adjust accordingly. Then once you have a market price available, you can compare your home to others that have sold. A home with a better location and layout for features will bring in a better price for the seller. However, without a professional appraisal of your home’s value, you risk either overpricing or under-pricing your home.

The Listing Agent is Incompetent or the Advertising is Poor

Most people rely on a realtor to list and manage your home’s sale. However, if the agent is inexperienced, dishonest or lazy, you will lose more money and time than if you sold the home yourself. Remember to take the real estate agent’s commission into account when determining the cost of selling your home. In addition, if you have not paid for extensive advertising or have poor quality photos of your home, it may be overlooked by buyers in favor of more prominent listings.

Your Home Needs Repairs or Updates

If your Phoenix or Tucson home does not have a new air conditioning unit (within the last 5 years) and other modern energy efficient appliances, you probably will not be able to sell your home. Most first-time homebuyers or prospective buyers with families will not have the cash on hand to renovate your outdated home, which narrows the range of potential buyers you will attract. A dirty and worn-down home will also not appeal to the majority of homebuyers. If you have a rundown property that needs a total renovation, you most likely will be unable to sell the home to an independent buyer. This leaves you with the options of renovating the home by yourself and gambling on the chance of actually seeing a return on your investment, or selling the home to a house-flipper or an equity purchase company like AllHomesAZ.com. A house-flipper will most likely have less capital to purchase the home than an equity purchase company, and an equity purchase company will have experienced appraisers on call to give you a fair price.

AllHomesAZ.com is comprised of a team of real estate investors and is a proud member of the Better Business Bureau. Based in Phoenix, Arizona, we buy homes anywhere in the USA for cash. For a free home appraisal and consultation with one of our agents, call 480.227.5214 or contact us online.

Moving with Pets

If you are relocating this summer, you are not alone. Millions of Americans move during these four months between Memorial Day and Labor Day, and many of those Americans have pets. A move to your new home can be stressful for you and your family, but even more so for your pets. And a stressed pet makes for an even more stressed family! Often on moving day, the family has so many other things to worry over, the pets become overlooked in the chaos. AllHomesAZ has over 10 years of real estate experience in Arizona, especially in the Phoenix Valley and Tucson area, and know exactly how challenging a move can be for the entire family. We have taken the time to prepare a quick guide for a less stressful transition for both you and your furry family members.

If you are relocating this summer, you are not alone. Millions of Americans move during these four months between Memorial Day and Labor Day, and many of those Americans have pets. A move to your new home can be stressful for you and your family, but even more so for your pets. And a stressed pet makes for an even more stressed family! Often on moving day, the family has so many other things to worry over, the pets become overlooked in the chaos. AllHomesAZ has over 10 years of real estate experience in Arizona, especially in the Phoenix Valley and Tucson area, and know exactly how challenging a move can be for the entire family. We have taken the time to prepare a quick guide for a less stressful transition for both you and your furry family members.

The most important thing you can do when preparing for moving day is to plan ahead. You already know you will need to transport your pet to your new home, so make arrangements before moving day so that there is no confusion as to how they will be traveling. Cats and other small animals will need to be in crates until you are settled into your new home, and dogs should either be in crates or wearing a seatbelt harness while in the car. Arizona weather can be difficult for your pet due to the heat, so be sure to prepare for the hot weather in Tucson and Phoenix. If you are flying, your pet must be in a crate as well if they are too large to sit in your lap. Be sure to contact your airline regarding their pet policies so that you may make proper arrangements and decide if flying is the right decision for your family.

It is also a given that your pet will need certification of their health. This includes their rabies vaccination tags as well as all of their documentation from your vet regarding their health. Most states, especially Arizona, also require you to register your pet, so you will need to make sure that they are up to date in the registry of the state where you will be living. Be sure to keep your pet’s medications on your person when traveling and bring a travel bowl with water and food in order to keep your pet nourished during this time. If the travel to your location cannot be completed in one day’s travel, make sure that the hotel where you will be staying allows pets before you ever start driving. You may even want to make boarding accommodations for your pet for when you arrive in your new town – just for a couple of days. This will help to keep your pet safe through the hustle and bustle of moving into your new home and allow you to focus on helping your pet acclimate to its new environment when you bring them into a home already filled with familiar scents and belongings. There are several great pet-friendly hotels and boarding kennels in Phoenix and Tucson. If you are unable to place the animal in boarding, it is best to keep them locked in an empty room of the house while you move your belongings in.

Remember, your pet does not understand what moving means and will probably be afraid. Be sure to give them plenty of attention and care. We advise placing a sheet over your pet’s crate so as to keep them calm while in a moving vehicle. It is important that the humans remain as calm as possible and do not make a big deal out of the new environment to the pets. By preparing your new home for your pet and retaining a positive and calm demeanor, you ease your pet’s anxiety and make it feel safe. As an extra precaution, do research about the area you are moving into so that you are aware of any dangers the environment may pose to your pet, such as ticks carrying Lyme disease or local rodents with their various contagions. While neither Phoenix nor Tucson have an abundance of ticks or rodents, these animals still do exist in Arizona. Learn the nearest location of an emergency vet well in advance of moving and research veterinarians in the area.

No matter the reason for your move, caring for your family – pets included – is of utmost importance. With proper planning, you can help make your relocation as stress-free and easy as possible. AllHomesAZ is an expert in Arizona Real Estate. We buy houses no matter their condition because we like nothing better than helping Phoenix and Tucson homeowners sell their homes quickly and easily. We can help you sell your current home or help you buy a new one. Give us a call today at 480.227.5214 or visit us online for more information.

A Guide for New Potential Homeowners

Buying your first home can be a very exciting time, yet scary as well. With such a large  investment, you should always do your homework before any costly mistakes are made. Here is a step-by-step guide for potential new homeowners.

investment, you should always do your homework before any costly mistakes are made. Here is a step-by-step guide for potential new homeowners.

Situating Finances

First of all, you must assess your finances to determine if you can buy a home, what your budget is and if there will be any red flags when attempting to mortgage. You can check your credit score online for free once a year. After acquiring your score, move to your annual income. When planning for a house, always think in terms of annually and not monthly.

You may be able to scrap your mortgage every month but you want a good deal of “wiggle room” to account for the down payment, renovations, closing costs, taxes and payment for the many contractors which will help you choose the right home (agents and appraisers). A general rule of thumb is that you should be able to offer a 20% down payment. There are also mortgage calculators available online that will determine the minimum you can pay monthly (never go with the maximum).

Assemble Your Team

Since this is your first time buying a home, you will need as much help as possible to assure you make the right decisions. This means acquiring a lender and real estate agent. There are many factors in choosing a lender, so it’s best to shop around for a reputable firm. Lenders give estimates during consultations and, although they aren’t concrete, they give you numbers to compare. You want an established lender who can offer both low rates and reliability. If your agent is late, non-attentive, pushy or, even worse, naïve, then it’s best to go with someone else.

House Shopping

The search for your dream house is the most exciting part of home buying. After determining budget, you must now choose what best suits your needs. Average homes have three to four bedrooms, two baths and a backyard. These might not fit your specific situation but they are the most sellable houses when thinking about a return on investment. Never shop with emotion, because this will cloud your judgment. Just because you love it, doesn’t mean it’s the wisest purchase.

Buyer Vs. Seller Duel

Once you’ve decided on a home that has been given the green light by your team, you can move into negotiations. All homes are priced higher than they sell for. Always look to negotiate, and expect several counter offers before settling somewhere in the middle. Once an amount is agreed upon, a modest money deposit is a good faith gesture that illustrates a serious interest in the property. It is usually credited to the down payment if the offer is accepted by both party lenders.

Mortgaging

Now you must decide on your mortgage program. There are three basic loans:

1. Adjustable Rate Mortgage (ARM) – a short term loan which has a fixed rate for the first years of the term (typically about seven) and then adjusts up or down for the remainder of the agreement. This is meant for those not planning to stay in the house for an extended period of time.

2. Fixed Rate Mortgage – This is the most traditional loan that offers a fixed interest rate for the duration of the loan, usually 15-30 years. In contrast to an ARM, this is for those planning on living in the home for a long period of time and therefore the predictable interest rate favors them in the end.

3. Interest Only Payment – Allows the buyer to pay the interest portion of the homes mortgage for a certain period of time. This frees up cash flow during this time period since paying only interest will lower the payments. This method will take you longer to pay off the principal.

Closing your new home

The final step in the process is the closing. At this point you have decided on the home, negotiated the price and acquired the best mortgage plan. Now you must decide on a deadline, but keep in mind the original owner might not have closed on their new home or you may still have to wait for your lease to end. Once the date is established, closing costs must be settled. This includes loan fees, inspection fees, real estate commission, Deed Stamps, Appraisal fees, taxes and much more. Once this is complete, you are now the proud owners of a new home.

If you’re looking to buy or sell your home, please give AllHomesAZ a call at (480) 227-5214. AllHomesAZ is a local company and a proud member of the Better Business Bureau. We are ready to make an offer for your current home and help you get into your new home fast!

Follow Us: